English | MP4 | AVC 1280×720 | AAC 48KHz 2ch | 2h 35m | 308 MB

Analyzing financial data can seem intimidating, but Microsoft Excel has a wide range of functions to perform these calculations quickly and easily. This course shows users how and when to use each of the financial functions available in Excel. Author Curt Frye covers evaluating loan payments; calculating depreciation; determining rates of return, bond coupon dates, and security durations; calculating prices and yields; and more.

Note: This course was recorded in Office 365, but anyone using a recent version of Excel—including 2019, 2016, and some earlier versions—will be able to follow along.

Topics include:

- Analyzing loans, payments, and interest

- Calculating depreciation

- Determining values and rates of return

- Calculating bond coupon dates and security durations

- Calculating security prices and yields

- Calculating security yields

- Evaluating the yields of securities with odd periods

Table of Contents

1 Perform financial analysis in Excel

2 What you should know

3 Disclaimer

4 PMT Calculate a loan payment

5 PPMT and IPMT Calculate the principal and interest per loan payment

6 CUMPRINC and CUMIPMT Calculate cumulative principal and interest paid between periods

7 ISPMT Calculate the interest paid during a specific period

8 EFFECT and NOMINAL Find nominal and effective interest rates

9 ACCRINT and ACCRINTM Calculate accrued interest for investments

10 RATE Discover the interest rate of an annuity

11 PDURATION Calculate the number of periods to reach a specified value

12 NPER Calculate the number of periods in an investment

13 SLN Calculate depreciation using the straight line method

14 DB Calculate depreciation using the declining balance method

15 DDB Calculate depreciation using the double-declining balance method

16 SYD Calculate depreciation for a specified period

17 VDB Calculate declining balance depreciation for a partial period

18 AMORDEGRC Calculate depreciation using a depreciation coefficient

19 AMORLINC Calculate depreciation for each accounting period

20 FV Calculate the future value of an investment

21 FVSCHEDULE Calculate the future value of an investment with variable returns

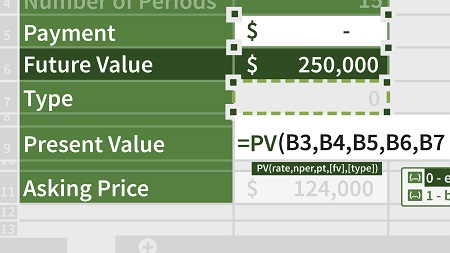

22 PV Calculate the present value of an investment

23 NPV Calculate the net present value of an investment

24 XNPV Calculate net present value given irregular inputs

25 IRR Calculate internal rate of return

26 XIRR Calculate internal rate of return for irregular cash flows

27 MIRR Calculate internal rate of return for mixed cash flows

28 RRI Calculate the interest rate for the growth of an investment

29 COUPDAYBS Calculate total days between coupon beginning and settlement

30 COUPDAYS Calculate days in the settlement date’s coupon period

31 COUPDAYSNC Calculate days from the settlement date to the next coupon date

32 COUPNCD Calculate the next coupon date after the settlement date

33 COUPNUM Calculate the number of coupons between settlement and maturity

34 COUPPCD Calculate the coupon date due immediately before settlement

35 DURATION Calculate the annual duration of a security

36 MDURATION Calculate the duration of a security using the Macaulay method

37 DOLLARDE and DOLLARFR Convert between fractional prices and decimal prices

38 INTRATE Calculate the interest rate of a fully invested security

39 RECEIVED Calculate the value of a fully invested security at maturity

40 PRICE Calculate the price of a security that pays periodic interest

41 DISC Calculate the discount rate of a security

42 PRICEDISC Calculate the price of a discounted security

43 PRICEMAT Calculate the price of a security that pays interest at maturity

44 TBILLEQ Calculate the bond-equivalent yield for a Treasury bill

45 TBILLPRICE Calculate the price for a Treasury bill

46 TBILLYIELD Calculate the yield of a Treasury bill

47 YIELD Calculate the yield of a security that pays periodic interest

48 YIELDDISC Calculate the annual yield for a discounted security

49 YIELDMAT Calculate the annual yield of a security that pays interest at maturity

50 ODDFPRICE Calculate the price of a security with an odd first period

51 ODDFYIELD Calculate the yield of a security with an odd first period

52 ODDLPRICE Calculate the price of a security with an odd last period

53 ODDLYIELD Calculate the yield of a security with an odd last period

54 Next steps

Resolve the captcha to access the links!